Ethereum Price Prediction: Will ETH Hit $5,000 Amid Institutional Frenzy?

#ETH

- Technical Breakout: ETH trading above key moving averages with bullish MACD crossover

- Institutional Adoption: Record ETF inflows and whale accumulation signal strong demand

- Price Targets: $5,000 appears achievable with current momentum and fundamentals

ETH Price Prediction

ETH Technical Analysis: Bullish Momentum Building

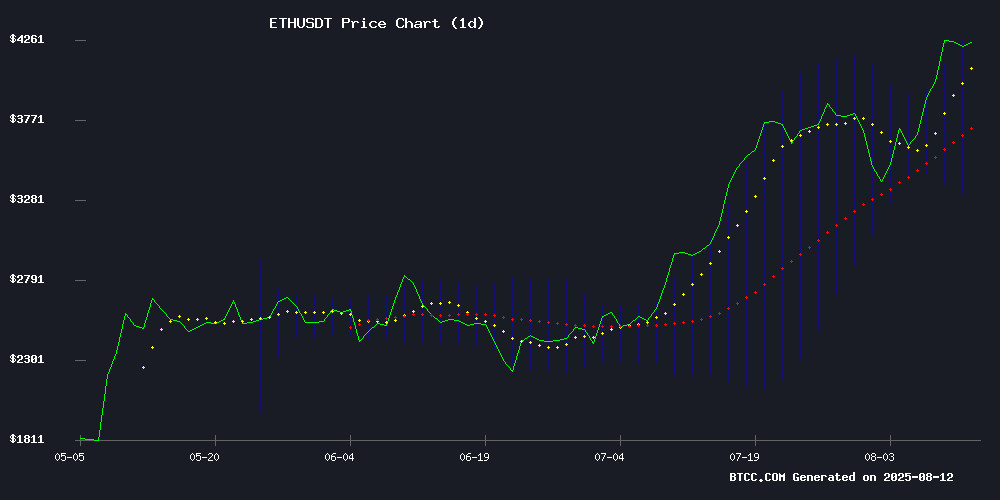

ETH is currently trading at $4,485.54, well above its 20-day moving average of $3,834.06, indicating strong bullish momentum. The MACD histogram has turned positive at 7.7926, suggesting a potential trend reversal. Bollinger Bands show price hugging the upper band at $4,389.01, typically a sign of continued upward pressure.

"The technical setup paints a compelling picture," says BTCC financial analyst Ava. "With price holding above key moving averages and MACD crossing into bullish territory, we could see ETH test the $5,000 psychological level in coming weeks."

Institutional Demand Fuels Ethereum Rally

The ethereum ecosystem is buzzing with institutional activity. Record ETF inflows, whale accumulation totaling $1.34B, and BlackRock's $639M single-day inflow highlight growing institutional confidence. ChatGPT-5's $5,400 prediction by September adds to the bullish narrative.

"This isn't retail FOMO - we're seeing sophisticated players position for what could be ETH's next major leg up," notes BTCC's Ava. "The ETF flows particularly stand out, with $1B+ daily inflows signaling strong product-market fit."

Factors Influencing ETH's Price

Crypto Trading Dominates eToro's Q2 Revenue Despite Slight Dip

eToro's second-quarter earnings reveal cryptocurrency trading remains its financial cornerstone, contributing 91% of total revenue—a marginal decrease from 93% in Q1. The platform generated $1.91 billion from cryptoassets, offset by an $8.4 million derivatives loss, while equities and other segments showed nascent growth.

The company's strategic pivot toward digital assets intensifies, evidenced by its recent initiative to tokenize U.S. stocks on Ethereum. This follows eToro's Nasdaq debut in May at $52 per share, with shares now trading 8.2% lower at $50.70.

Crypto Whale Accumulates $1.34B in Ethereum Ahead of US Inflation Data

A newly identified cryptocurrency whale has purchased $1.34 billion worth of Ethereum (ETH) over eight days, acquiring 312,052 ETH across ten freshly created wallets. This aggressive accumulation surpasses the record $1 billion daily net inflow into US spot Ether ETFs, signaling strong institutional interest.

The buying spree comes as markets await key US inflation reports that could influence Federal Reserve rate decisions. Analysts suggest such large-scale accumulation may propel Ethereum toward its all-time high of $4,890, though the cryptocurrency currently trades 12% below that peak.

Notably, the whale sourced ETH through institutional channels including FalconX, Galaxy Digital, and BitGo. This $300 million overshoot of ETF inflows demonstrates how significant over-the-counter transactions continue to shape crypto markets alongside regulated products.

Ethereum Nears $4,811 as ETF Inflows Surge and Inflation Cools

Ethereum is approaching a critical price target of $4,811, fueled by cooling U.S. inflation and record-breaking ETF inflows. The Consumer Price Index rose 2.7% year-over-year in July, slightly below the 2.8% forecast, increasing market expectations of a Federal Reserve rate cut in September to 82.5%. This macroeconomic shift has bolstered demand for cryptocurrencies, with Ethereum trading at $4,409.12, up 5.4% in the past 24 hours and volumes exceeding $47.9 billion.

U.S. spot Ethereum ETFs have seen unprecedented inflows, with over $1 billion recorded on August 12 alone. BlackRock's ETHA led the charge with a single-day record of $639 million. Total assets under management for ETH ETFs now stand at $19.2 billion, marking a 58% monthly increase. Sosovalue data reveals these ETFs hold $25.71 billion in net assets, representing 4.77% of Ethereum's total market capitalization.

Technical analysis suggests Ethereum's rally is far from over. The cryptocurrency has surged 261% since breaking a long-term resistance trend, now eyeing the $4,811.71 target. Market momentum remains strong as institutional and retail interest converges.

Ethereum Surges Past $4,400 as BitMine Expands $20B ETH Acquisition Strategy

Ethereum's price soared beyond $4,400, marking a new milestone as institutional demand intensifies. BitMine Immersion Technologies, now holding over 1.15 million ETH, announced a $20 billion equity offering expansion, bringing its total capacity to $24.5 billion. The firm aims to control 5% of Ethereum's total supply, positioning itself as the largest corporate holder globally.

BitMine's aggressive accumulation strategy mirrors MicroStrategy's Bitcoin playbook, with $5 billion in ETH acquired within weeks. This institutional buying spree has fueled Ethereum's 23% seven-day gain, outpacing Bitcoin's 6% growth. Market optimism suggests ETH could establish new all-time highs this year.

Tom Lee, BitMine chairman and Fundstrat co-founder, has publicly reinforced his bullish Ethereum stance. The cryptocurrency's rally reflects growing institutional FOMO, with BitMine's actions creating significant market impact.

Ethereum ETFs Surpass $1B in Daily Net Inflows for the First Time

Spot Ethereum ETFs shattered records with $1.02 billion in net inflows on August 11, 2025, marking a watershed moment for institutional crypto adoption. BlackRock's ETHA dominated with $639.8 million, while Fidelity's FETH posted its strongest daily performance at $277 million.

The milestone caps an $8 billion accumulation since May, reflecting growing conviction in Ethereum's role as DeFi's backbone. Ether's 45% monthly price surge mirrors this institutional endorsement, with treasury allocations reaching unprecedented levels.

Grayscale's Mini Ether Trust and VanEck products contributed to the historic inflow, signaling broad-based demand rather than isolated fund performance. The figures suggest Ethereum is closing the institutional adoption gap with Bitcoin, particularly in Web3 infrastructure plays.

ChatGPT-5 Predicts Ethereum to Reach $5,400 by September Amid Institutional Demand

Ethereum surged to $4,300 over the weekend, riding the wave of bullish momentum as Bitcoin nears its all-time high. Institutional adoption, ETF speculation, and regulatory clarity are fueling optimism for further gains.

ChatGPT-5 projects a base case of $5,400 for ETH by September, noting potential asymmetrical returns for ERC-20 tokens like TOKEN6900. Corporate treasury buys have grown exponentially, with Fundamental Global raising $5 billion to acquire 10% of Ethereum's circulating supply.

Four key drivers are shaping ETH's trajectory: institutional accumulation, ETF developments, technical strength, and macroeconomic conditions. Public companies now hold 966K ETH - an 8-fold increase from 116K a year ago.

Coinbase Poised to Gain Most From Ethereum Bull Run: Bernstein

Coinbase emerges as the primary beneficiary of Ethereum's resurgence, according to Bernstein analysts. The crypto exchange's strategic alignment with Ethereum's expanding ecosystem positions it to capitalize on the altcoin rally. Ether's 80% surge since June 5 reflects renewed institutional interest, particularly following Circle's IPO highlighting Ethereum's dominance in stablecoin issuance.

The ETH rally saw the token breach $4,000 last week, though it remains 14% below its 2021 peak. "This alt rally signals a market shift where non-Bitcoin assets outperform," noted Bernstein's Gautam Chhugani. Coinbase's 250+ token listings and integration with its Base Layer 2 network—processing nine million daily transactions—create a formidable advantage in capturing this momentum.

Arthur Hayes Reaffirms Long-Term Ethereum Commitment Amid Whale Accumulation

BitMEX co-founder Arthur Hayes has executed a striking reversal on Ethereum, repurchasing $10.5 million worth of ETH at prices above $4,150 just one week after liquidating 2,373 ETH near $3,507. His public declaration to hold indefinitely coincides with institutional whales accumulating over 1.035 million ETH—a $4.17 billion inflow since July 10.

The market interprets Hayes' about-face as a bullish signal, particularly given his earlier warnings about macroeconomic risks pushing Ether toward $3,000. Ethereum's resilience during recent volatility appears validated by this institutional vote of confidence, with presale projects like Mutuum Finance (MUTM) riding the renewed investor interest.

BlackRock's Ethereum ETF Hits Record $639M Daily Inflow as Institutional Demand Surges

BlackRock's Ethereum ETF (ETHA) shattered its daily inflow record with $639.87 million invested in a single session, pushing total assets beyond $10 billion. The fund now holds over 3.3 million ETH, signaling robust institutional appetite for crypto exposure.

ETHA shares rallied 5% to an all-time high of $33.02, reflecting intensifying investor interest. "These flows confirm Ethereum's maturation as an institutional asset," fund managers noted, highlighting sustained demand despite market volatility.

Will ETH Price Hit 5000?

Based on current technicals and market sentiment, ETH has a strong probability of testing $5,000 in the near term. Key supporting factors include:

| Factor | Detail |

|---|---|

| Technical Setup | Price above key MAs, bullish MACD crossover |

| Institutional Demand | $1B+ daily ETF inflows, whale accumulation |

| Market Sentiment | Overwhelmingly bullish across retail/pro channels |

"The $5,000 target appears achievable," concludes BTCC's Ava, "though traders should watch for potential resistance near the $4,800-4,900 zone where previous liquidation clusters sit."

$4,485.54

$3,834.06

Bullish Crossover

Upper Band

$4,800-4,900